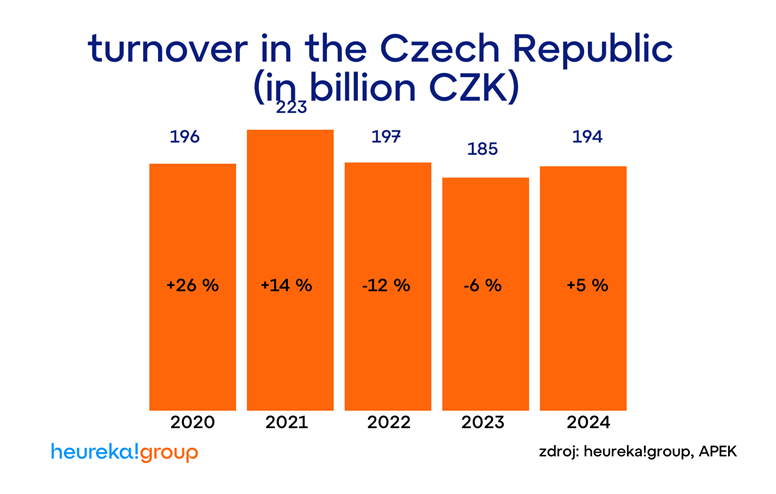

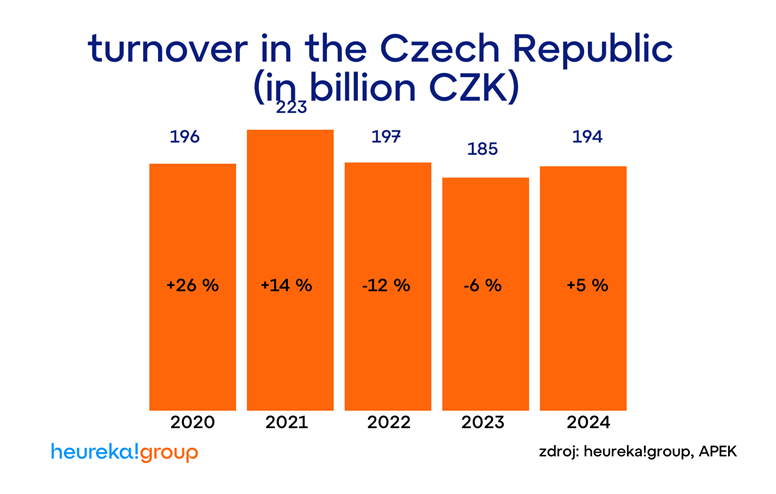

Czech e-commerce ended 2024 with a total turnover of CZK 194 billion, up 5% year-on-year

Czech e-commerce ended 2024 with a total turnover of CZK 194 billion, an increase of 5 percent year-on-year. The overall annual score was improved by the traditionally strongest last quarter. The categories associated with sustainability and leisure enjoyed the strongest growth last year. A regular summary of the development of Czech e-commerce is provided by the eCommerce Insider of the shopping guide Heureka.cz and the Association for Electronic Commerce.

The year 2024 was characterised by balanced growth across all quarters. While the first and third quarters showed interesting growth (up 4% in Q1 and even 5% in Q3), Q2 saw growth maintained at 3%. The last quarter, with 6% year-on-year growth, confirmed that it is traditionally the strongest. These figures show that even though consumers are starting to shop again, they remain cautious in their spending. Just for comparison, in 2023, Czech e-commerce sales were six percent below the previous year.

The average order value decreased slightly to CZK 1,333 in Q4, indicating that people shopped online not only for gifts but also for daily necessities at lower prices. Satisfaction with online shops, on the other hand, rose to 96.3%.

"The year 2024 was a period of gradual growth for Czech e-shops and our data clearly shows that the Czech economy is reviving. Concerns about inflation and rising energy prices have partially eased, and Czechs have continued to make online purchases they had been putting off, even buying goods that were previously not as available online," says David Chmelař, CEO of Heureka Group, adding: "It is also interesting to look at the strongest months. Compared to previous years, December reigned supreme for Christmas online shopping. The otherwise dominant October and November were among the weaker months this year, with shoppers largely leaving their gift buying until December, also due to the weather. However, e-shops coped well with this, showing an increase in customer satisfaction."

Slight consolidation continued among e-shops

The majority of e-shops managed to get through the challenging period, but nevertheless a slight consolidation continued and the number of e-shops decreased slightly. Last year was again affected by high inflation, which meant rising costs for retailers, alongside a reduced willingness to spend among consumers. Therefore, the number of e-shops on the Czech market fell slightly from 49,900 to 49,700. On the other hand, the adaptability of the majority of Czech online shops was again confirmed, as they were able to cope with the challenging situation and the entry of foreign marketplaces outside the EU. They will therefore enter 2025 with optimism.

"Basically, from the first months of last year, we saw e-commerce returning to growth after two years of turbulence. We expect this to continue in 2025 at a similar level," comments Jan Vetyška, Executive Director of the Czech E-Commerce Association, adding: "In retrospect, we can see that after the extremely successful years associated with the covid pandemic, there has subsequently been a certain leveling off to normal. On a normal trajectory, we would very likely be at similar turnover levels to what we are seeing now. I believe that Czech e-commerce still has a positive future ahead of it."

Development of individual categories

During 2024, the categories related to sustainability and leisure activities will see the most significant growth in the Czech online market. The biggest "jumpers" of the year were:

Solar accessories.

Cycling shorts: up 694%, showing that outdoor activities and healthy lifestyles continue to be popular.

Solar kits: An increase of 604% indicates a trend towards choosing comprehensive solar energy solutions.

Children's garden furniture: An increase of 562% confirms that parents are investing in their children's backyard fun and comfort.

Coffee and coffee substitutes: The 474% increase reflects the growing interest in alternatives to traditional coffee.

Conversely, categories that have peaked in previous years, such as:

Soda maker accessories: the 86% decline reflects a saturated market and declining interest in home preparation of sparkling beverages.

Wedding Dresses: A 79% drop indicates less glamorous weddings or a decline in online demand in this category.

Children's jackets: With a 75% decline, we can assume less seasonality and competition from traditional retail.

Operating Systems: The 73% decline indicates that this category has reached saturation and buyers are often opting for long-lasting licenses.

These declines indicate market saturation and a change in customer priorities towards current trends and practical products.

Summary and outlook

The Czech online market continues to show high dynamics. The variety of products on offer and the improved customer experience show that e-shops can respond effectively to changing consumer needs. The coming year 2025 will be an opportunity for retailers to further strengthen their market position.

"We believe that with the increase in digitalisation, the implementation of artificial intelligence and the arrival of more foreign players, Czech e-commerce will continue to develop. It will be important to maintain a high standard of service and focus on individual customer needs," concludes David Chmelař, CEO of Heureka Group.

"Czech e-commerce has had a successful year. Our e-shops have once again confirmed that they can quickly adapt to new trends and customer demands. In 2025, more challenges and fierce competition await them. In any case, I am convinced that they will cope with them again and Czech e-commerce will continue to grow and develop," comments Jan Vetyška, Executive Director of APEK.