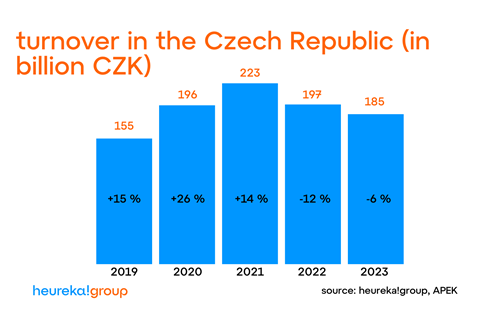

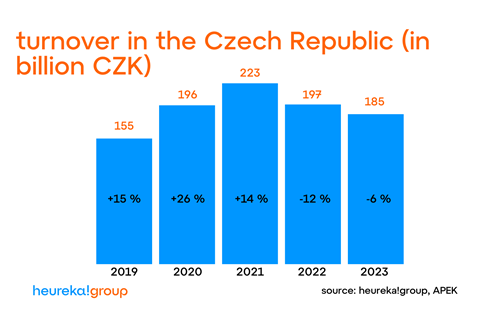

Christmas shopping brought e-commerce back to a 2% growth in the last quarter, ending the year with an overall -6% compared to last year.

12. 01. 2024 | Lucie Dlouhá

Czech e-commerce concluded the year 2023 with a total turnover of 185 billion Czech crowns, representing a 6% decrease compared to the previous year. The overall annual score was improved by the traditionally strongest last quarter, which achieved a 2% growth after many months of decline. The market, thanks to decreasing inflation and the entry of foreign players, began to revive, especially benefiting large e-shops.

A regular summary of the development of Czech e-commerce in the past year is provided by eCommerce Insider, the shopping guide Heureka.cz, and the Association for Electronic Commerce (APEK).

The nearly two-year decline in revenue for online stores has finally stopped. The final quarter, which traditionally ranks among the most crucial periods of the year, shifted the quarterly results to a 2% growth. Data from Heureka, on which the regular eCommerce Insider is based, clearly shows that Czech e-commerce is beginning to revive after a long period of stagnation, with major players confirming that the situation is starting to turn around.

"For the first three months of last year, we had a year-on-year decline of 13%, still grappling with high inflation, and even the previously popular post-Christmas sales were not successful. The hope for a return to natural growth came after the second quarter, which ended at -8%. May was particularly strong, with the monitored values approaching zero. However, hopeful prospects evaporated in a warm and especially long summer, and the third quarter ended again at -11%. We observed, however, that people had become accustomed to shopping online, just purchasing items with lower value, which also reflected in a lower average order value," reflects on the past year David Chmelař, CEO of Heureka Group, and adds: "We eagerly awaited the end of the year, which is one of the strongest in e-commerce, and indeed, we achieved the best result for the whole year.

Market Stabilization and New Challenges for E-shops

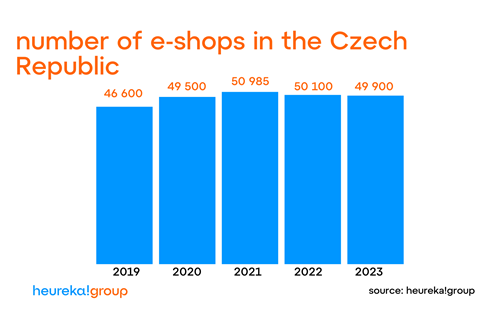

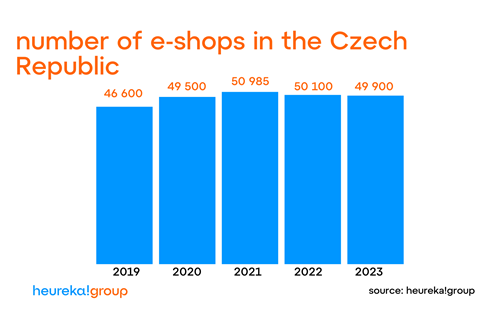

Most e-shops managed to navigate through a challenging period; however, there was still a slight consolidation that began in 2022. "Last year was once again influenced by high inflation, which meant increasing costs for merchants, coupled with consumers' reduced willingness to spend. This led to a slight decrease in the number of e-shops in the Czech market from 50,100 to 49,900. On the other hand, the adaptability of most Czech online stores was once again confirmed, as they were able to cope with the challenging situation and will enter 2024 with optimism. We believe that our e-commerce is now poised for a return to growth," comments Jan Vetyška, Executive Director of the Association for Electronic Commerce (APEK), and adds, "The online market is constantly evolving dynamically. New foreign players are entering it, and customers expect better and better services. Artificial intelligence is also increasingly entering the game. And we must not forget that the new generation of shoppers differs in several aspects from the previous ones. Certainly, there will be no shortage of new challenges for our e-shops."

Gradual Transformation of Online Shopping

In previous years, merchants with goods that were previously only available in brick-and-mortar stores penetrated the e-commerce environment. "People want to take advantage of online shopping regardless of the type of goods. They want the ability to compare prices, read reviews, and choose a seller that suits them, offering the best service for the money spent. They also purchase items with a lower purchase price online, which can gain e-shops regularly returning customers," adds Jan Mayer, CEO of Heureka CZ/SK. The most significant shift to the online environment occurred during the pandemic, and newly created segments have managed to maintain their share. Electronics is still the strongest, but it has gradually declined from 25% in 2019 to the current 22%. On the other hand, the cosmetics and health section has gradually grown from 6% in 2019 to the current 8%.

Category | 2019 | 2020 | 2021 | 2022 | 2023 |

Sexual and erotic aids | 1% | 1% | 1% | 1% | 1% |

Food and drinks | 2% | 2% | 2% | 2% | 2% |

Movies, books, games | 4% | 4% | 3% | 3% | 3% |

Building Materials | 3% | 3% | 3% | 3% | 3% |

Hobby | 5% | 5% | 5% | 6% | 6% |

Furniture | 5% | 6% | 6% | 6% | 6% |

Automotive | 7% | 6% | 6% | 6% | 6% |

Children products | 7% | 7% | 7% | 6% | 6% |

Apparel and fashion | 6% | 6% | 7% | 6% | 6% |

Cosmetics and health | 6% | 7% | 6% | 7% | 8% |

Sport | 8% | 9% | 9% | 9% | 9% |

Household appliances | 10% | 10% | 10% | 10% | 10% |

Home and garden | 10% | 12% | 13% | 13% | 12% |

Electronics | 25% | 24% | 22% | 22% | 22% |

Source: heureka!group

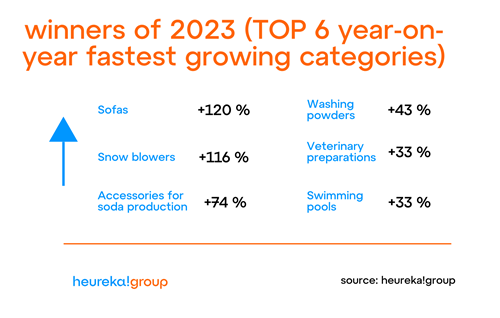

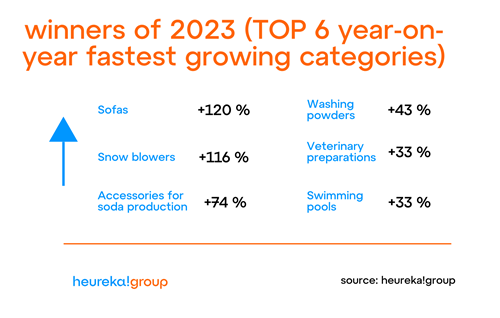

These changes bring greater diversity in the most frequently searched segments. Throughout the year, products in the category of drugstore and cosmetics held very high positions in the ranking of the most popular categories, such as laundry detergents (+43%) or dishwasher products. One consequence of the pandemic is the more frequent search for veterinary products (+33%) and pet food, which people acquired while spending time at home.

Shopping was also significantly influenced by the long, warm summer. "All merchants know that weather plays an important role, and we see it too. For example, pools in the third quarter increased by 106% year-on-year and ranked among the fastest-growing categories of the year with a 33% growth. But it also works the other way around; once it snows, Czechs look for sleds, snow shovels, or snow blowers, which grew by 116% year-on-year," Mayer adds. After a period of decline, the vacuum cleaner market is beginning to revive, ending 2022 with a -22% result, while last year concluded with a 6% growth, and the upward trend continues in the first days of 2024.

"It has once again been shown that Christmas is important to people, and they want to bring joy to their loved ones, even if they watch their expenses more for the rest of the year. Of course, we all wish that the trend from the last quarter could be maintained in the coming months, but the question remains about how the Czechs' purchasing power will be affected by the austerity package that came into effect in the Czech Republic in January," concludes David Chmelař.